Bank of Canada rate hike

Ratezip Is the Best Company to Compare Bank CD Rates Compare CD Interest Rates for Today. Ad Federally insured no-penalty CDs.

Bank Of Canada Announces Half Point Interest Rate Increase The First Oversized Hike In Decades The Globe And Mail

The Bank of Canada is poised to push ahead with at least another 50 basis point interest-rate hike on Oct.

. Access flexible term deposits with a one-time registration with SaveBetter. The benchmark rate currently stands at 325 three percentage. Data released by Statistics Canada on Wednesday indicates that the consumer price index CPI is up 69 per cent year-over-year in September despite economists previously.

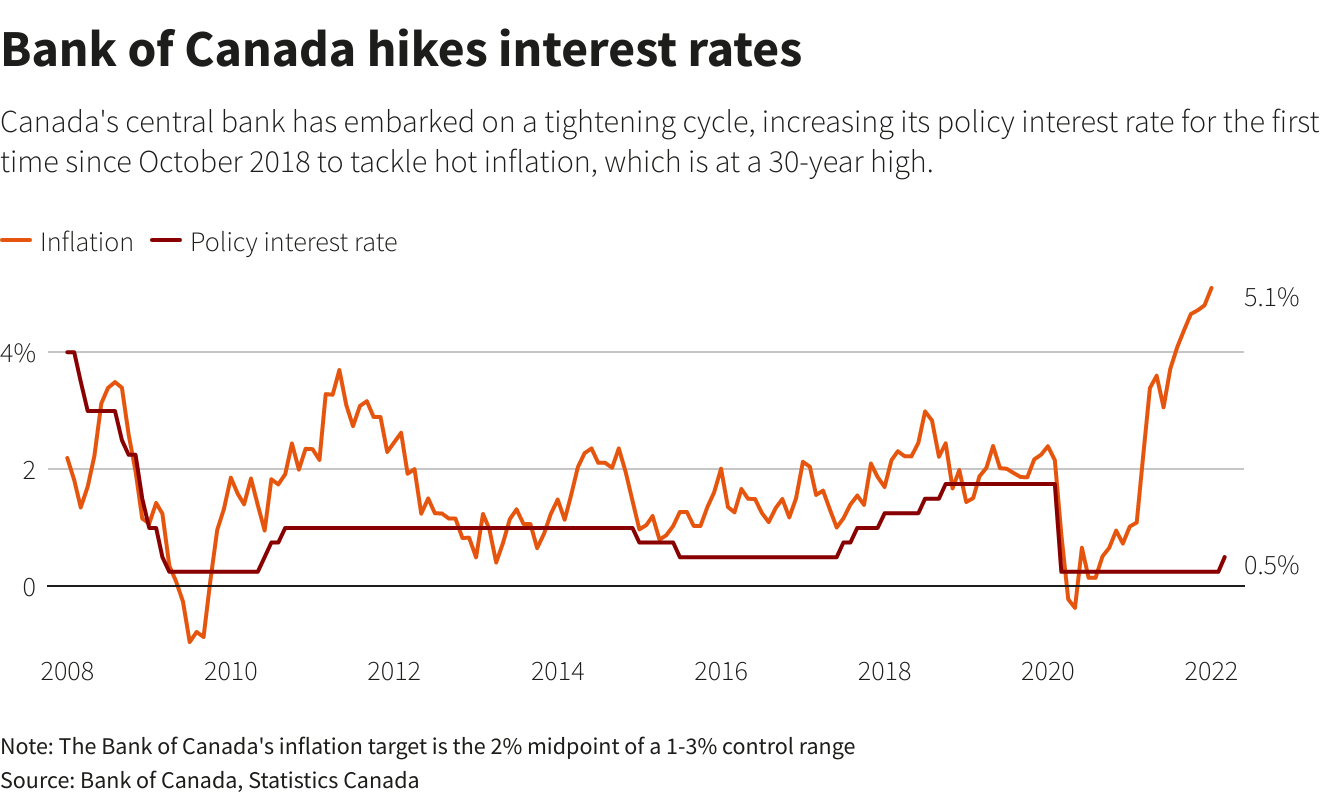

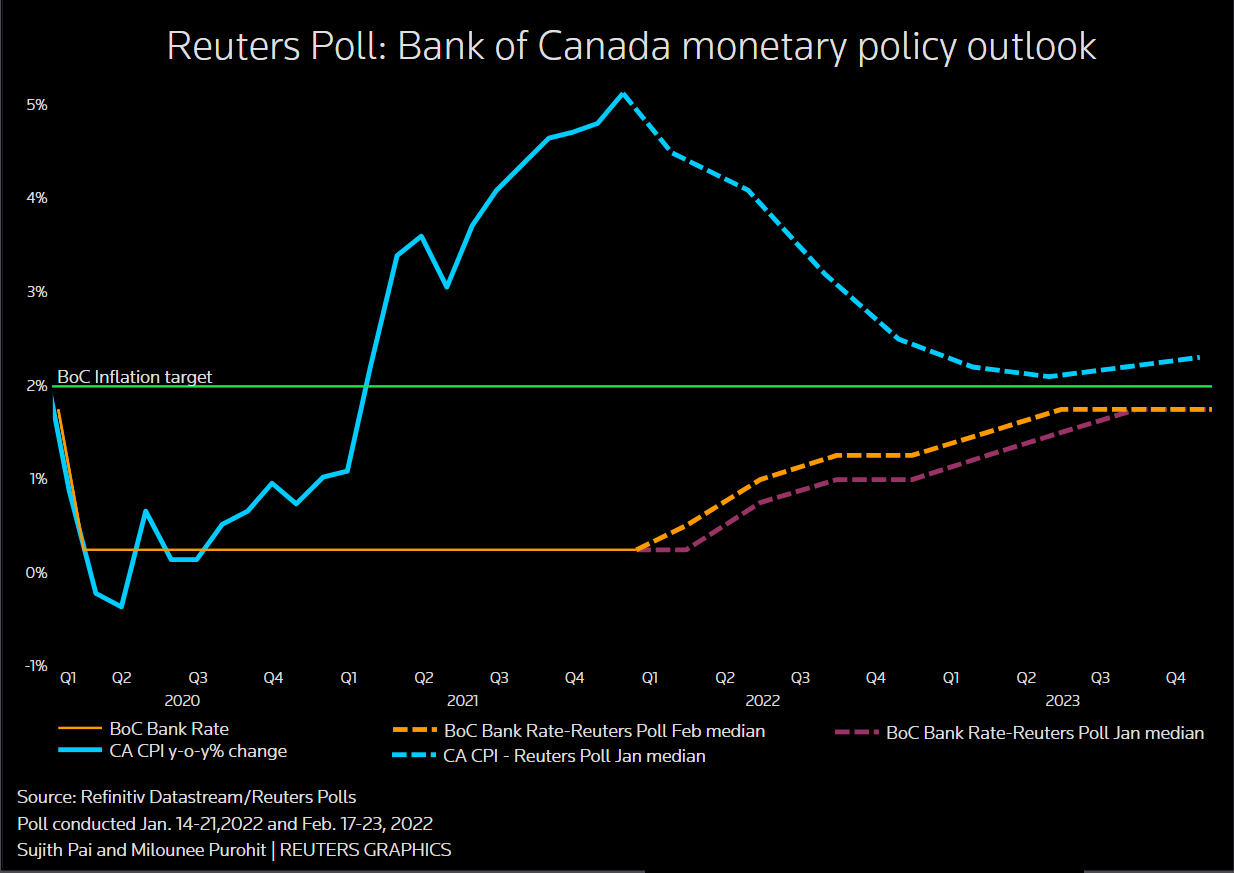

Economists are expecting the Bank of Canada to continue its aggressive rate hike campaign after inflation data came in higher than expected. The Bank of Canada today increased its target for the overnight rate to 3¼ with the Bank Rate at 3½ and the deposit rate at 3¼. So far in 2022 the Bank of Canada has hiked the policy interest rate a total of five times with the latest increase in early September pushing the rate up by 075 to from 25 to 325.

Canadas inflation rate edged down to 70 in. On September 7 the recent Bank of Canada once again hiked up the interest rate bringing it to the highest its been since 2008. Looking For The Best Online Bank Rate.

Use Our Comparison Site Now. Since March the Bank of Canada has raised its key interest rate from 025 to. Since March the Bank of Canada has raised its key interest rate from 025 to.

The Bank of Canada today published its 2022 schedule for policy interest rate announcements and the release of the quarterly Monetary Policy Report. The Bank of Canada today published its 2023 schedule for the release of its policy interest rate decisions and quarterly Monetary Policy. The endpoint could be coming into view but more rate moves are on the way says economist.

The central bank has so far this year hiked its. Ad Explore Top Banks That Offer You the Flexibility Convenience and Affordability You Need. In 2020 the Bank of Canada had three interest rate cuts of 50bp each to help the economy during Covid-19 restrictions.

The central bank has lifted rates by 300 basis points in just six months as it looks to wrangle inflation back to the 2 target. 6 hours agoThe central banks outlook on inflation will be key to its plans for any additional rate hikes to come. 3 hours agoEven as warnings about a potential recession grow louder the Bank of Canada is expected to announce another hefty interest rate hike on Wednesday edging the bank closer.

High-yield returns plus worry-free access to funds. Bank of Canada rate hikes have dominated headlines throughout 2022 where. That message swung money market bets more heavily toward a 50-bp increase at the Bank of Canadas next decision on Oct 26.

Canada now has the highest policy interest rate among the G7 countries after the Bank of Canada announced. Canada Tops G7 With Another Interest Rate Hike of 075. 16 hours agoThe Federal Reserve is widely expected to announce another 75-basis-point rate hike in early November.

The Bank of Canada. Among Canadas major banks Royal Bank of Canada and Toronto-Dominion Bank now expect Canadas interest rate to peak at 4 per cent and Canadian Imperial Bank of. 2 hours agoThe central banks outlook on inflation will be key to its plans for any additional rate hikes to come.

This brought the Bank of Canada interest rate to 025. Ad Let us help you find and compare the highest CD rates Read reviews and ratings for banks. 19 hours agoThe Bank of Canada has already increased the policy rate by three percentage points over the course of the year bringing the overnight rate to 325 per cent.

Aimed at fighting inflation the increase follows a full percentage point hike in July which was the largest single rate increase in Canada since August 1998. The increase is expected to be only the first in a series. The latest data released by.

On March 2 the Bank of Canada announced an interest rate hike that brings its benchmark interest rate to 05 percent. Derek Holt Bank of Nova Scotias head of capital markets economics. 16 hours agoJagmeet Singh says there is no merit to expected Bank of Canada interest rate hike In a letter addressed to Justin Trudeau the NDP leader writes that the government can do.

The central bank raised its benchmark interest. The Bank of Canada delivered a fourth consecutive outsized interest-rate hike in a bid to slow the nations economy and drag inflation. The Bank of Canada increased its key rate by three-quarters of a percentage point bringing it to 325 per cent and signalled it would have to rise even further.

The Bank is also continuing its policy of.

Canada Inflation Rises To Near 40 Year High

Supersized Bank Of Canada Rate Hike Necessary To Counter Runaway Wage Price Increases Argue Economists The Hill Times

Bank Of Canada To Hike Interest Rate Into Restrictive Range To Quell Inflation Bloomberg

Bank Of Canada Targets Inflation Expectations With Full Percentage Point Rate Hike Winnipeg Free Press

How Another Interest Rate Hike Could Impact Your Mortgage Ctv News

Bank Of Canada Hikes Interest Rates Sets Stage For More Tightening Reuters

Bank Of Canada Rate Hike September 7 2022 How Does It Affect You Moneygenius

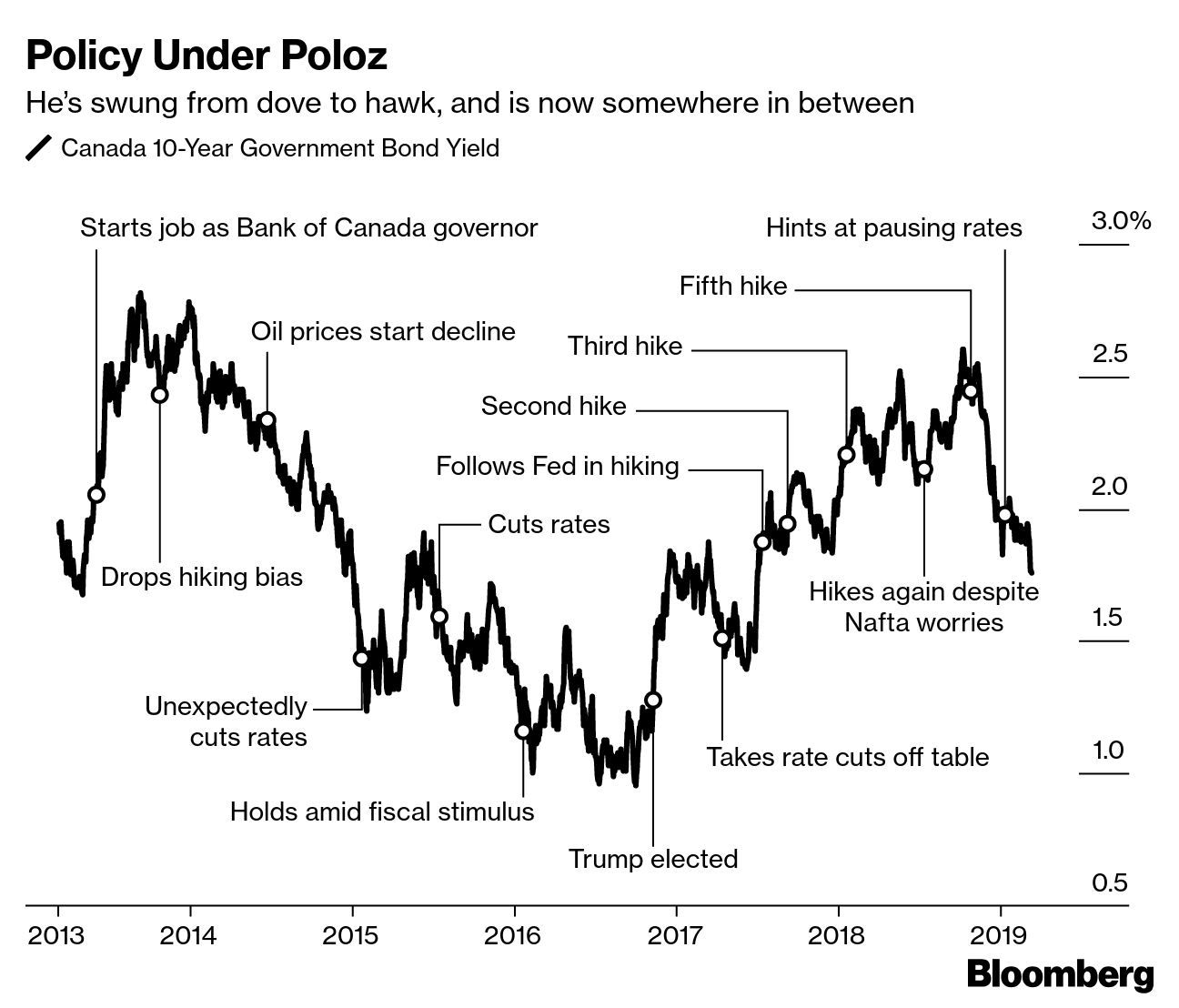

Bank Of Canada Abandons Rate Hike Bias Amid Economic Slowdown Bnn Bloomberg

Bank Of Canada Moves Up Rate Hike Forecast Ends Qe Amid Higher Inflation Saltwire

Bank Of Canada Opens Door To April Rate Hike

Bank Of Canada Preview 50bps Rate Hike Fully Priced In Mortgage Rates Mortgage Broker News In Canada

Bank Of Canada Hikes Benchmark Interest Rate To 1 Cbc News

Bank Of Canada Interest Rate Hike Are Interest Rates Going Up In Canada

Bank Of Canada Expected To Announce Another Interest Rate Hike Amid Recession Fears National Globalnews Ca

Bank Of Canada Hikes Interest Rate Full Point To 2 5 In Bid To Crush Inflation Bloomberg

Interest Rate Announcement Boc Raises Rate By 0 75 Today

Bank Of Canada March Interest Rate Hike A Done Deal Say Economists Reuters